Inequality and the Macroeconomy: Academic and Policy Challenges

IMPA celebrated its first anniversary on April 17, 2024, with a colloquium on Inequality and the Macroeconomy: Academic and Policy Challenges.

The first session featured academic inquiries related to IMPA’s mission, and the second session featured a panel discussion of the 2024-25 tax debates.

Academic Inquiries

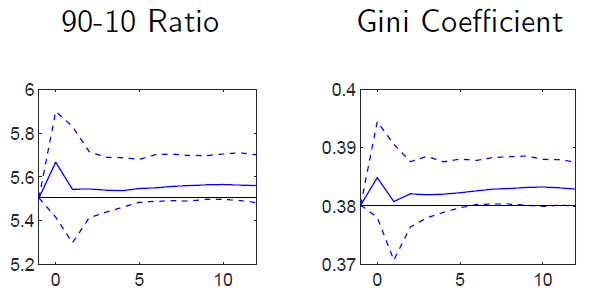

Minsu Chang, (Assistant Professor of Economics at Georgetown University) presented “On the Effects of Monetary Policy Shocks on Income and Consumption Heterogeneity” The paper uses a new framework to show that monetary policy shocks may increase consumption inequality. The estimates of the impacts, however, are imprecise. This focus corresponds with IMPA’s work studying the implications of policy outcomes on income and wealth inequality.

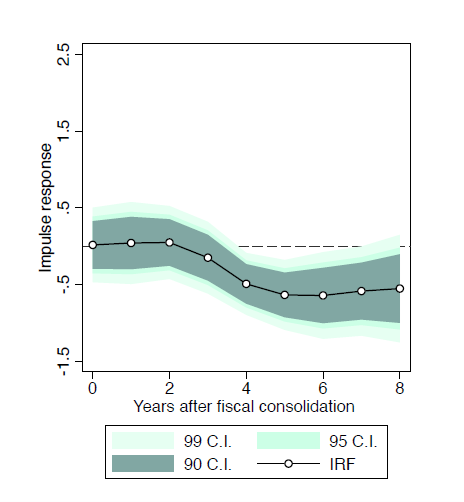

Selin Seçil Akin (Postdoctoral Research Fellow in Economics at American University) presented “Gender Perspectives on Fiscal Policy and Debt,” which explores the asymmetric effects of fiscal policy on gender-specific employment outcomes. The presentation summarized work from Seçil’s dissertation showing that fiscal consolidation decreased women’s labor force participation relative to men’s, and it previewed ongoing work showing that countries with more social infrastructure spending increases opportunities for women relative to men. Seçil’s work complements IMPA’s mission to account for differential impacts when evaluating the impact of policy.

The 2024-2025 Tax Debates

In her introduction, moderator Sarah Anderson (Director of the Global Economy Project and Co-Editor of Inequality.org at the Institute for Policy Studies) emphasized that now an interesting time in tax policy. The 2017 Tax Cuts and Jobs Act (TCJA) has many pieces expiring soon. Regardless of who wins the White House in 2024, there will be a tax policy debate. Addressing students, she noted that there is a need for people with expertise in taxation who bring “a public interest lens to the work.” This was particularly important, she emphasized, because the tax system is important for a healthy economy and a healthy democracy.

Sara first asked Rakeen Mabud (Chief Economist and Managing Director of Policy and Research at the Groundwork Collaborative) to summarize her view of the impact of the TCJA. Rakeen explained that, while the supporters of the TCJA promised broad positive impact, 80 percent of the benefits of the tax cuts went to the richest 10 percent of households, while median wage growth slowed in 2018 and 2019. Additionally, the TCJA incentivized stock buybacks, which not only displaced investments but also sharply increased wealth inequality. The TCJA therefore provided another example of how trickle-down approach doesn’t work. She also emphasized that the upcoming debates were an opportunity – a chance to redraw the rules to build an economy for the future that works for everyone. To that end, she advocated opening the debate beyond the expiring provision to include raising the top corporate tax rate.

Niko Lusiani (Director of the program on Corporate Power at the Roosevelt Institute) asked the audience to think about “four Rs” that represent the four purposes of taxes: (1) revenue, (2) redistribution, (3) regulation, and (4) representation. He focused on the last two. Historically, corporate taxes were part of Progressive Era antitrust regulation. The idea was to disincentivize firms from accumulating too much market power. By “representation,” he meant that a fair tax system is intended to enhance public trust in government. He advocated for raising the top corporate rate and returning to a graduated corporate tax system, noting that a recent study of 10,000 large multinational companies found that supernormal returns (or “rents”) were 70 percent of total profits. Supernormal returns were concentrated in the largest companies, and in particular US headquartered in the U.S.

IMPA Co-Director Ignacio Gonzalez (Assistant Professor of Economics at American University) emphasized that the current opportunity to reshape the tax code differs from the tax overhauls of the 1980s and early 2000s because economists have an improved understanding of the effects of changes in taxes. For example, he said that it is well understood that taxes on dividends don’t have negative effects on investment, something that was not recognized earlier. Thus, the tax code can be harnessed more effectively today to address wealth inequality. He advocated thinking of dividend taxes, capital gains taxes, and corporate taxes as elements of a unified policy to reduce inequality. Importantly, he said, the key policy question is not whether to raise the corporate tax, but how much to raise it. He suggested the optimal rate is probably higher than the 28 percent being discussed these days.

Susana Ruiz (Global Lead on Tax Justice at OXFAM International) emphasized the importance of the international aspect of corporate tax law, focusing on three elements: the tax rate for multinational corporations, a tax on the global wealthy, and international tax governance. In addition to avoiding a race to the bottom by agreeing on rates, she noted that it’s important for countries to agree on how define the tax base for the corporate rate. This task is complicated by the emergence of corporations without a “home country,” and the digitalization of commerce. This trend in globalization has allowed the wealthiest to evade taxes everywhere, further contributing to global inequality. These issues raise the question of how – and by whom – the international tax system should be managed. Susana expressed optimism that the task of redesigning the 100-year-old corporate tax system to match modern needs of a truly global economy would be undertaken at the United Nations rather than being wholly located in rich countries.