The IMPA Model

As essential tools for policymakers and other stakeholders, macroeconomic policy models estimate the long-run economic effects of legislative and regulatory proposals on the economy. Model results have important implications for the types of policies that are understood to be beneficial, or detrimental, to the size of the economy (as measured in GDP) and the distribution of employment, income, and wealth.

The IMPA model is a macroeconomic policy model built on recent advances in economic theory and contemporary empirical evidence. Importantly, the model emphasizes income and wealth inequality, the widespread prevalence of market power in labor and goods markets, productive public capital, labor market segmentation, and the nuances of the U.S. tax system. All together, the model is equipped to make long-run economic and distributional assessments of the impact of proposed policies.

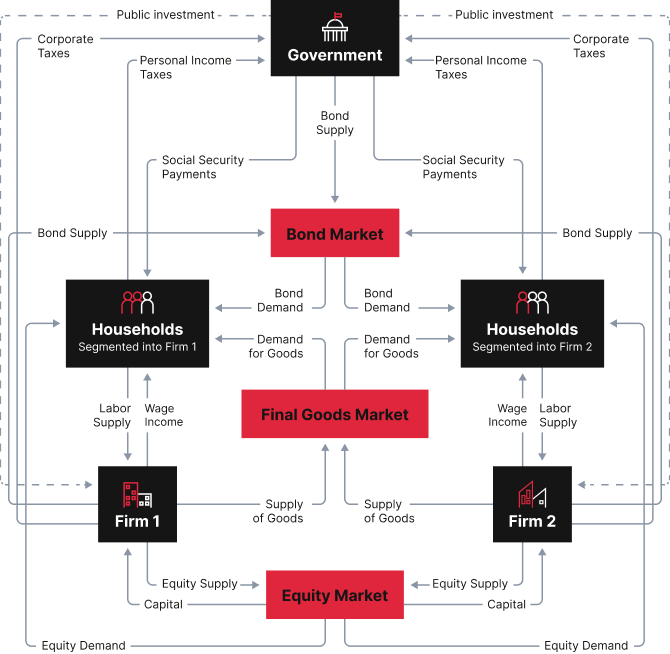

The economy in the model is made up of three types of actors, three types of markets, and the relationships between each of them. Below is an explanation of the main actors and the key insights of our model.

The Three Types of Actors

The three types of actors in the IMPA model include households, firms, and the government.

Households consist of the workers and consumers in the economy. They decide how much to work and in return receive wages, purchase goods and services, pay taxes, receive social welfare payments, and invest their savings into bonds (both private and public) and stocks.

Firms belong to different sectors of the economy and are heterogeneous, meaning they vary in size, productivity, and market shares. Firms hire workers and pay wages, issue equities (stocks) and bonds, produce goods and services which they sell to households, make capital investments, and pay taxes. They also benefit, in varying amounts, from public investment which makes firms more productive.

The government collects taxes, distributes social welfare programs, issues bonds (government debt, such as Treasury bills), and engages in public investments, such as infrastructure and human capital.

The Three Types of Markets

The three types of actors interact with each other in the economy in three types of markets: the bond market, the final goods market, and the equity market.

In the bond market, the government sells bonds to firms and households to finance expenditures, and firms sell bonds to households to finance investments. Different households earn different rates of return depending on the composition of their portfolios.

In the final goods market, goods and services are supplied by firms and bought by households, firms, and the government for their consumption and investment needs.

In the equity market, firms sell stocks to households. As in the bond market, different households earn different rates of return depending on the composition of their portfolios.

The IMPA Model

Key Innovation: Market Power

The IMPA model accounts for the fact that market power is pervasive in the economy.

Market power is the idea that corporations can exert control over the prices they charge consumers and the wages they pay workers, beyond what would be possible in a truly competitive market. Market power exists in both the labor market, where powerful firms are able to suppress workers’ wages, and in the goods market, where dominant firms charge markups on the goods and services they sell.

Accounting for market power is imperative because it affects how the economy functions and therefore changes the implications of macroeconomic policy interventions.

For example, contemporary academic research has shown that labor markets are monopsonistic – individual firms are concentrated buyers of labor in their markets – and that employers thus exert significant power over wage setting and other aspects of the employment relationship. In contrast to a model that assumes labor markets are competitive, minimum wage policies in the IMPA model need not reduce employment, in line with recent empirical evidence.

Market power also has implications for both income and wealth inequality. In the labor market, otherwise equal workers that are employed in firms with different degrees of market power will earn systematically different wages, increasing income inequality. Market power rents earned in the goods and labor markets are distributed to shareholders in the form of dividends and capital gains. This directly generates wealth inequality since stocks are primarily owned by wealthy households, while suppressing wages for workers at the bottom of the distribution.

Market power also distorts the allocation of capital across activities in the economy. For example, when market power rents generate excess profits for dominant corporations and these corporations pay out these inflated profits to shareholders, it drives up expected returns to equity and thus the cost of true productive investment economy-wide. This distorts investment decisions at all firms and directs funds toward high-rent sectors at the expense of productive activity. Under realistic assumptions about market power, corporate income taxes can correct the misallocation of capital created when firms with market power extract excess profits for shareholders. This can increase investment and economic performance and put the brakes on wealth inequality.